Apply the Highest Hourly Rate Based on the Union Code

OBJECTIVE

For workers outside of Québec working for certain unions, the hourly rate used must be the highest of the following two rates: the base rate for the union to which the employee belongs (as defined in Employee Management) or the hourly rate for the union entered in the various hour entries.

PREREQUISITEs

- Union Management

- Employee Management(Defining a default union code in Employee Management)

- Define Hourly Rates(Defining hourly rates by union)

APPLICATION

While searching for the hourly rate applicable to an hour entry transaction, if a union code exists in the transaction AND if the employee’s file contains a default union code, the systems conducts two searches for an hourly rate. The first search uses the union code mentioned in the transaction and the second uses the employee’s default union code. If the hourly rate returned in both cases is associated with the specified union code, the system compares the two hourly rates and uses the highest of the two.

Example of an employee working on a project with a union different from his default union.

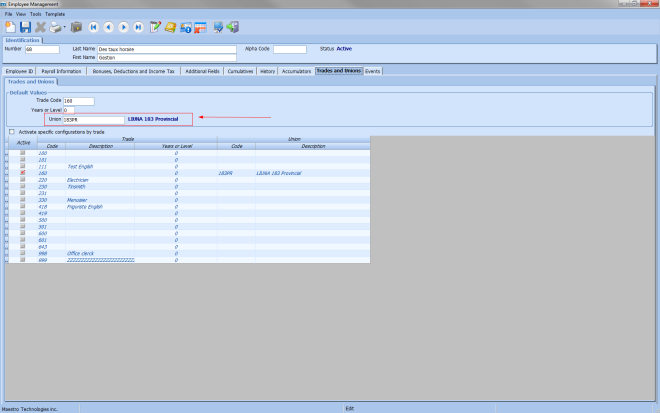

Employee Management

In the example below, the employee is member of union 183PR by default.

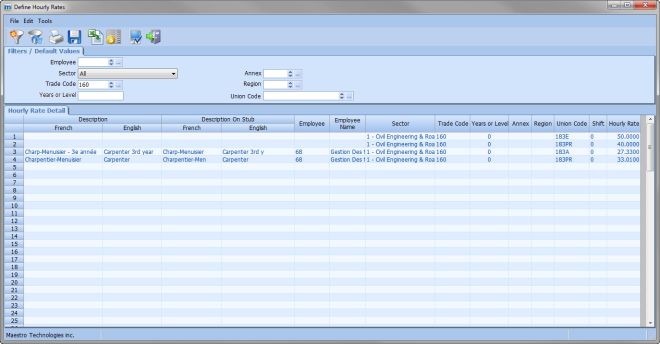

Define Hourly Rates

- There is an hourly rate of $27.33 for employee 68, trade 160 and union code 183A.

- A second hourly rate was created in the amount of $33.01 for employee 68, the same trade code (160), but with a different union code (183PR).

- A third hourly rate was created in the amount of $ 50.00 for union code (183E).

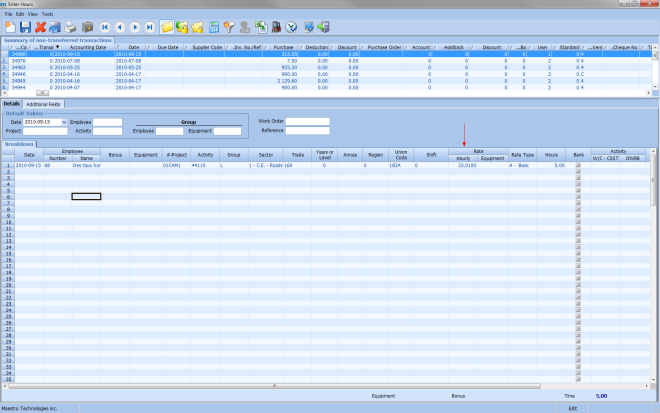

Enter Hours

1st case: The hourly rate for the union in the transaction is lower than the default hourly rate for the union.

The employee will be paid based on his default union, which is 183PR, because the hourly rate is higher than the union in the transaction. His hourly rate will therefore de $33.01 rather than $27.33.

2nd case: The hourly rate for the union in the transaction is higher than the default hourly rate for the union.

The employee will be paid the hourly rate of the transaction because the hourly rate is higher than the default union rate.

| Warning. The other deductions associated with union codes will be calculated based on the union entered in the transaction, not the default union. |